In this lesson we take a look at forex trading essentials and everything you need to get started. In our previous lesson , we took a look at the currency pairs and quotation.

You noticed that there are two prices in-front of the currency pairs. Now the question is, why do we then see two rates on one currency pair?

How can there be two different rates for a single pair currency rate? Well, in forex trading, the rate at which you sell your currency is different from the rate at which you buy the currency. These rates are called the bid rate and the ask rate.

There are images that I will share later in this article that will help you understand what I am talking about.

Let us try to understand what bid rate and ask rate are and the purpose behind this.

Bid Rate

The bid rate refers to the price that the dealer or the broker is willing to pay for a currency.

Ask Rate

This is the price at which the dealer will sell the same currency. To understand this, let us take an example. These two, bid rate and ask rate are two of the basic forex trading essentials

Let’s say you live in India and you’re traveling to the United States. And for that you’ll have to exchange your INR to USD. We can assume that USD is the base currency of your broker.

When you want to exchange your INR for USD, the broker will offer you a rate to buy your INR and give you the USD

The rate the broker offers you to buy your INR is called the ask rate. Let us say that after few days, you went back to India from the United States and you still had few dollars left on you.

Now to exchange that dollar for INR, you went back to the broker, this time the broker will give you a rate at which it is willing to buy your USD in exchange for the INR. This rate is called the bid rate.

Always remember that in the forex market or any exchange market, the asking rate will always be more than the bid rate. Thus, the broker will sell its base currency for more value and will always offer a less rate for buying the same base currency.

The main purpose behind this is that brokers earn money through this process. The difference between the asking price and the bid price is the profit that the broker makes. The difference between the bid price and the asking price is called the spread.

Here is an image that illustrates the bid price, the asking price and the spread. So to find the spread, you’ll just have to subtract bid rate from the asking rate.

To sum up, the bid rate is how much the broker sells its base currency and buys a valuable currency. The bid rate is the price at which the broker sells its base currency and have in mind that this rate is lower than the asking rate. It’s normally quoted on the left hand side as shown in the image below.

This means that the asking rate is the price the broker buys its base currency and this rate is always higher than the bid rate. It’s normally quoted on the right side as seen in the image above.

Finally, the difference between the asking rate and the bid rate is called a spread

What Is A Pip? An important forex trading essentials

What are pips and why is it one of the important forex trading essentials? This is one of the most important forex trading essentials , in forex trading all the profits and loss are measured in pips. But why is that so? Why do we measure profit and loss in pips?

Let us try to understand everything that you need to know about a pip. As you know, there are many different currencies in the world of which there are eight major currencies in the forex market.

When a trader trades any of the currency pairs, is it easy or difficult for them to remember every small value of every currency? The answer is no, it isn’t.

So to make it easy to calculate the price movement, a standardized unit was introduced and it is called a pip.

A pip is nothing but the smallest measure of change in the value of the currency pair. Pip is however not the only smallest measure.

After the introduction of pips, the pipette was also introduced. This is a smaller value of the pip or a fraction of a pip.

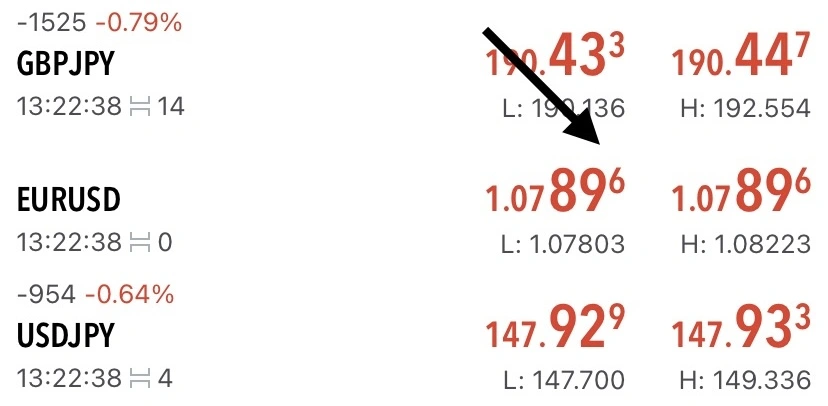

Now I want you to look at the image below carefully and you’ll notice that in front of every symbol, there is a value which is also called the quote.

You can see that at the end of the quoted value, there is a small number. This number or value is what we call the pipette. Do not forget that everything here including a pipette are important forex trading essentials

In forex trading, when pip is being calculated you’ll have to exclude the value of pipette. Now let’s learn how to calculate pips.

For example let’s assume that USD/CAD was at 1.3300 then it moved to 1.3400. By looking at this, we can say that this pair moved 100 pips.

Let us take another example, let’s USD/JPY was at 110.35 then it moved to 111.00. This means that USD/JPY moved 65 pips. So if you have entered at a buy rate then you’ll have a profit of 65 pips. This also means if you entered at a sell rate then you’ll have had a loss of 65 pips.

The profit and loss are further calculated based on the lot size that you are using and well this leads us to our next point.

What is a lot size? Forex Trading Essentials

From the beginning of human civilization, humans have assigned certain units to everything we buy outside.

From gasoline to gold, it’s measured in certain units and you’ll have to buy or sell them in those particular units. This is also one of the important forex trading essentials.

Consider the fact that you go out to buy a can of milk, how do you measure the quality of milk that you are buying? It is obvious that you’ll have to buy it in terms of liters. In the same way, when you buy or sell anything in the forex market, you do that in a unit called a “lot”.

In the forex market or in forex trading, LOT is a unit that traders buy and sell currencies. There are different lot sizes and each lot size has a certain value assigned to it. For example, if you buy 10,000 units of any currency, you’ll have to use 1 mini lot size and base on this you have profit and losses.

There are four different types of lots and they are:

Standard lot size

Mini lot size

Micro lot size

Nano lot size

Standard lot size

One standard lot size is equal to hundred thousand units of any currency you are buying or selling. One standard lot is denoted by “1.0”. So if you open a trade with a lot size of 1.0, it means that you are buying 100,000 units. Now, pay attention because this is one of the most important forex trading essentials, this is how you lose or make money

For example, you open a buy trade on USD/JPY with a lot size of 1.0, this means you have got 100,000 units of US dollars. Note that when you use a standard lot size, every pip is equal to $10.

This means that if you open a buy trade with 1 standard lot size and you gain profit of 100 pips on that trade, you’ll have a total profit of $1,000. This is because for 1 standard lot, one pip is equal to $10.

Mini lot size

One mini lot size is equal to ten thousand units of currency that you are buying or selling. What it means is, if you open a trade with a lot size of 0.10, you are buying or selling 10,000 units of that currency.

For example, if you open a buy trade on USD/JPY with one mini lot (0.10), this means that you have bought 10,000 units of US dollars. And 1 mini lot size is denoted by “0.10”. In 1 mini lot size, 1 pip is equal to $1.

This basically means that if you open a buy trade with 1 mini lot size and you have a profit of 100 pips on that trade, you’ll have a total profit of $100 because with 1 mini lot size, 1 pip is equal to $1

Micro lot size

One micro lot is equal to one thousand units of the currency you are buying or selling. This means that if you are opening a trade with a lot size of 0.01, then you are buying or selling 1,000 units if that currency.

For example, if you open a buy trade on USD/JPY with 1 micro lot size, you bought 1,000 units of US dollars. 1 micro lot size is denoted by “ 0.01”.

With this, 1 pip is equal to $0.10 which means if you open a buy trade with 1 micro lot size, 100 pips of profit on that trade will give you a total profit of $10.

When it comes to 1 micro lot, one pip is equal to $0.10.

Nano lot size

This is the last one and 1 nano lot size is equal to hundred units of the currency you are buying or selling. If you are opening a trade with a lot size of 0.001 then, you are buying or selling 100 units of that currency.

For example, if you open a buy on USD/JPY with one nano lot (0.001), you bought 100 units of US dollars. One nano lot is denoted by “0.001”. Here, 1 pip is equal to $0.01.

Generally, when you open a buy trade with 1 nano lot size and you get a profit of 100 pips on that trade, you will have a total profit of $1.

This is because with one nano lot size, 1 pip is equal to $0.01. That’s all for this class and I’ll see you in the next one which has been linked below

Next class: What Is Commission In Forex Trading? | Full Details

Also, if you missed our previous lesions, here’s a link to it here: What is forex trading? | Everything You Need To Know As A Beginner. Also, you can find the full course from the start to the end in the course section below

FULL COURSE: Forex for beginners

Pingback: What is forex trading? | Everything You Need To Know As A Beginner - 7educate.com

Pingback: What Is Commission In Forex Trading? | Full Details - 7educate.com