If you find yourself on this website and particularly on this article then I guess you are a beginner looking for the best scalping strategy that will elevate your trading career to the next level.

In this article, I’ll do you favor of giving you the most simple yet powerful scalping strategy that will make you tons of money each day. With that said, I want us to delve deeper into this scalping strategy.

First of all, there are 3 major trading styles. These are, swing trading, day trading and scalping. This means there are basically three types of traders on the market.

In other articles that will soon be published on this website, we’ll delve deeper into both swing trading and then day trading. Today we shift our focus on scalping.

What is scalping in forex trading?

Scalping in forex trading is when you enter trades, wait for price to drop in your favor for few seconds or minutes and then closing your profits as fast as you can.

Personally I refer to scalpers as the “hit and run” traders. This is because they do not spend much time on the charts, just a couple of minutes and the money is already in the bag and they are good to go.

So if you are that kind of trader who doesn’t have patience to wait for a set up, confirm on a lower timeframe and all the noise, scalping is for you. You enter a trade and in few minutes, you close your trade. That’s it.

It sounds exciting right? Well, if I’ll be honest with you, it’s not all that simple as it may seem. If you do not master the basics of scalping or have the best scalping strategy, you’ll easily liquidate or blow your account.

We’ll soon get into this best scalping strategy with a win rate of 85% that’s going to help you become a successful trader even if you lose a trade. But before that, you need a broker. A broker that offers you the best in terms of spreads, withdrawal processes that are convenient and available as well as fast when it comes to delivering.

Personally I use the Exness broker to trade. It’s by far one of the best brokers you’ll find out there. They give you access to several trading pairs that most brokers will not give you. The most exciting thing that makes me love Exness is their leverage options.

For a scalper like me, this is the best because it goes all the way to give me a leverage of 1:2000 which in my opinion is very cool. You can attest to this yourself but 80% of brokers only go as far as 1:400, that’s their limit. And also, if you trade a certain amount, you’ll gain access to the 1: unlimited leverage option.

This is ideal for scalpers and I highly recommend you get the Exness broker if you haven’t yet. Here’s a link to sign up for free so you can start making money with this strategy that I’m about to show you. Use this link to sign up: Exness.org

Now that you have signed up on the Exness broker, it’s now time to know about this strategy. First of all, there are some indicators you’ll need. For this part, I assume you all have a trading view account.

Traders normally use trading view to analyze the charts and then execute trades with either their brokers directly or with MT5/MT4. I highly recommend you sign up for fading view as well. They have a free plan which I think is enough for you especially as a beginner.

The Heikin Ashi breakout scalping strategy

I know you are used to trading with the normal candle sticks, all traders are used to that. But personally, my trading success rate skyrocketed about an 85% after I discovered this candlestick type called the Heikin Ashi Candlestick.

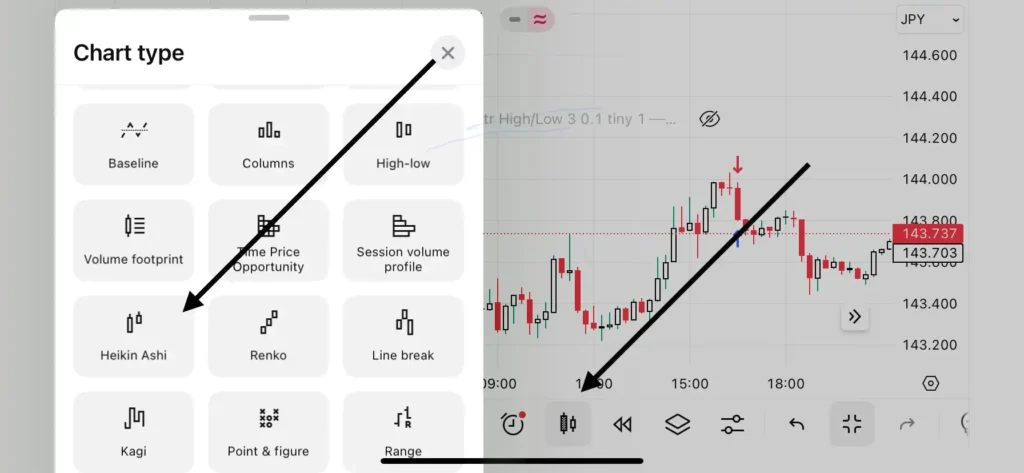

It is with this candlesticks that we are going to be making tons of money with in at the end of this article. Now, to get this candlesticks on your trading view chart, just head over to the types of chats section and then locate and click on Heikin Ashi.

After doing that, your chart so look exactly like what in the image below.

Now that you have switched to the Heikin Ashi chart, one indicator that you’ll have to add to your chart is the “ Volume Weighted Average Price”. You can change the color to whatever suits you. I recommend you leave it as it is.

Now, the role this indicator plays in this is that when the chart is below the volume weighted average, you only look for short opportunities. Same applies to when the chart or price is above the line, you look for long opportunities. It’s that simple, trade with the trend as the saying goes.

The next thing is that you have to be on the one minute timeframe (M1), this is because it’s a scalping strategy and we are not on the charts to hold trades for hours or days.

And one more important tip before we move on, if you want to scalp, you should scalp high volume pairs like NAS100, XAUUSD and more. You do not want to scalp pairs like EURUSD or GBPJPY. We do not want to stay in trades for almost forever.

The major pairs generally do not have high volume movement like a NAS100 or XAUUSD would so keep that in mind that this best scalping strategy or scalping in general works better on highly volatile pairs.

Now let’s get back on track, if you have your indictor in place as well as the Heikin ashi chart it means you are good to go. As I mentioned above, you trade with the trend.

With that said, let’s take an example where price is below the trend line “our indictor”, that means we are only looking to sell. Now all you have to do is wait for price to have a pullback and then you catch the trade back down

I will show you what a valid trade looks like, this will give you a fair understanding of what I’m talking about here. For a trade to be valid, here are the confluence you must consider.

First of all, after the pullback, wait for a minimum of two Heikin Ashi candles in the position direction with a flat bottom. This is very important so pay critical attention.

As shown in the image above, price was below the VWAP and we waited for a pullback, and then we saw two Heikin Ashi candles in the opposite direction. What it means is that if you are looking to sell, you look for a pullback to the upside.

And in that pullback, you should see at least two candles with a flat bottom. The next thing to wait for is a flat bottom candle to the downside “that’s if you’re selling” after the pullback. It’s okay of the first candlestick has wicks or doji and also do not mind if the last candlestick has has the same.

What matters is the fact take you see at least two Heikin Ashi candlesticks with a flap bottom in that pullback formation and that’s it, you can enter the trade. Put your stop loss right below the high of the recent pullback and then aim at a risk to reward ratio of 1:2

You can aim for more, but my little advice is that do not be greedy, just keep it simple, maximize your profits, go out there and live the life you always dream of.

The reason why a risk to reward ratio of 1:2 is the best for this scalping strategy is that if you trade 5 times a day and you lose 2 trades and win 3 out of the 5 trades, you still be in profit.

Let’s just say you risk $50 to make $100 per trade. In 5 trades it is expected that you gain $500. Now let’s assume you lost 2 trades which is equivalent to $200 but won 3 trades out of a total of 5 trades, you still go home with a profit of $300. So at the end of the day, even though you had some loses, you’ll still remain on profit.

And that’s it for now, this is the best scaling strategy you can ever find that will aid you to become a very successful trader. Keep in mind that you’ll have to backtest this multiple times with your Exness free demo account to see how it works before you invest real money.

If you want to learn more about how you can be a successful trader as a beginner, consider checking out our text article full course that show equips you with all you need to become successful at trading in the link below:

Full Course On: Forex for beginners

Pingback: How To Trade Order Block And FVG| Best Trading Strategy - 7educate.com