In this article we take a look at how to avoid inducement in forex trading. This article will be simple but very informative so make sure you stick around right until the end of this article.

Now, inducement is very important when it comes to being a successful trader, this means that if you pay deaf ears to inducement, you’ll likely lose 70% of your trade even though your base trading strategy confluences are 100% correct. We are here because sporting inducement levels can be tricky and difficult.

So today I’ll make things very easy for you. At the end of this article, you’ll know what inducement levels are, how to spot them on the market with two strategies and how to avoid them.

Before we get started, I’d like to introduce to you the number one beginner friendly trading broker in the world as we speak. Exness broker is the best broker for you either as a beginner trader or an advanced trader and here’s why:

Exness has got lower spreads compared to other brokers out there, and with beginners in mind, Exness allows you to trade with as low as $10. This barely happens on most brokers that you know.

Lastly, Exness has the best leverage deals in the industry and this is a no brainer. For a beginner, you get to set your leverage all the way to 1:3000 which is great for traders who trade high volume pairs like NAS100 and more. And depending on your region, you get access to a leverage of 1: unlimited after about $500 trades.

So, what are you waiting for? Create a free account with Exness today and catch all the goodies before it’s too late. Now let’s get back to business

What Is Inducement In Forex Trading?

The simplest explanation for a better understanding, inducement are basically like liquidity zones that incites traders to enter premature trades and later lose money because in the end, price hits their stop loss.

It’s very much okay if you barely knew about what inducement is and if it even existed. I was just like you when I started my forex trading career. Back then, information wasn’t this easy to come by compared to now.

Even all the great traders you know or see around are always tempted by inducement. Spotting inducement setups will save you a lot of money. And make you a profitable trader in the shortest possible time.

I have already mentioned that inducements are liquidity zones that price eventually sweeps or grab before tapping into an order block or fvg. Yes that’s true, but there is a twist to this that makes it difficult for even expert traders to identify inducement zones.

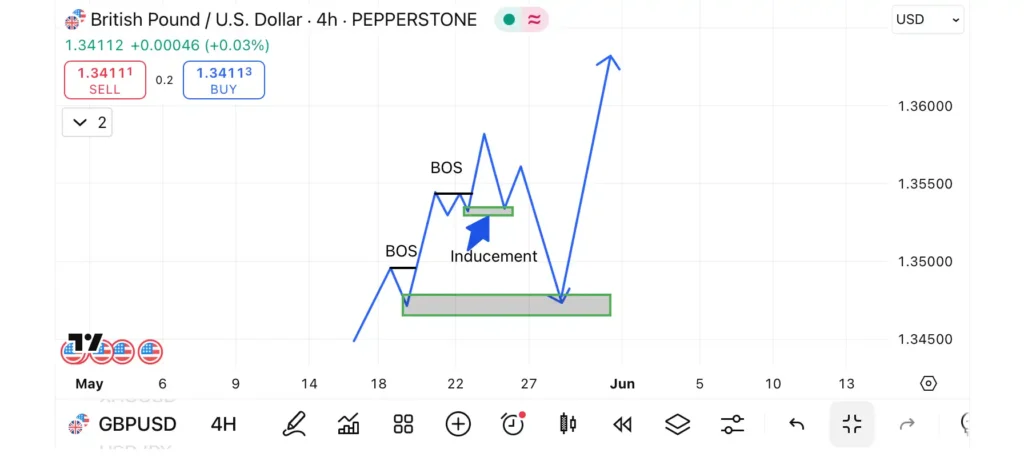

But after this article, you’ll be able to master the art of sporting inducement zones. Here’s an illustration of an inducement zone.

What did you observe? You observe that price broke structure, we mapped out our order block because we mentioned in our previous articles that the first confluence that validates an order block or fvg is a break of structure.

So, instead of price to come and respect our order block zone, it only pulled back a little and then created another high by breaking the previous high where we spotted or order block.

How tempting is this? Most traders will ignore their initial order block zone and go with the idea that, once price has created a new high, it’s only going to respect the order block of that recent high and not the one previous marked out

What happened next is that price tapped into the order block of the inducement trap, pretended to be going away and then went all the way down to tap into our original order block we first marked out.

Here’s a pure example om how inducement looks on the real charts. This is to show you that inducement levels are a real stop hunter, again, study this and you’ll be miles ahead of your fellow beginners in this forex trading business.

If you got fooled by the inducement trap, you will most likely hit stop loss, and then you’ll see price now going in your favor after that. And you’ll always be like “ price always hit my stop loss and then move into my intended direction after that”.

All these are avoidable if you can master and be able to point out various inducement levels or zones on the chart. Now this is very important, trading requires lots of patience, once all your confluence are present, do not be quick to change your marked out zones thinking that price has left you.

Well, there are cases and instances that price will not come back to respect your marked out zones but that’s absolutely fine. At the end of the day, you lost nothing which is better than rushing with impatience and losing all your money.

Forex trading isn’t about the number of trades you take in a given time, it’s about how consistent you are with profitability. Keep this in mind, just be patient and you’ll be successful.

If for anything you’re confused about this and still find it difficult to spot inducement levels, just take out your Fibonacci retracement tool, if it’s a short or sell trade, you put it from the swing high to the swing low. Your attention should be on the 0.79. Any origin that’s around 0.5 or 0.618 is an inducement level.

You do same when it’s a long or buy trade. That’s the easiest way to make a decision when you have doubts about price creating a new high without coming back to tap into your marked out zone.

This brings us to the end of this article. Our team is here with you to help you succeed. So, if you have questions with regards to how to avoid inducement levels, kindly leave them in the comment section below and we’ll get back to you as soon as possible

If you are new to this website or forex trading in general, consider taking our free text course on trading for beginners here: Forex for beginners

Previous article: How To Trade Order Block And FVG| Best Trading Strategy

Pingback: Risk Management In Forex Trading | How To Be Profitable - 7educate.com