Today we take a look at how to trade order block and fvg in forex trading. By the end of this, you’ll be able to spot trading opportunities by yourself and also start making money from the comfort of your home with forex trading.

Trading off order blocks and fvg has a high success rate depending on how you approach it. In this article I’ll show you the basic fundamentals and rules that beginners can use to earn money trading order blocks and fvg.

Before we get things started, as a beginner you’ll need a broker. Not just any broker but a broker that has you the trader at heart. Getting a huge capital as a beginner trader might be tough and it’s very understandable.

So a broker that lets you trade with a minimum of $10 is a gem and a huge opportunity to take advantage of. Exness is by far the best broker that ticks all the boxes.

Available in almost all over the world, the payment system is fast with several withdrawal options that suits you perfectly your country or region. With that said, I’ll encourage you to create an account with Exness

They also have the best leverage system compared to some of the famous brokers out there. So, I do not need to convince you that much before you know that Exness is the best broker for you while starting out. You can use this link “ Exness.org “ to create and account and you’ll never regret this.

Now let’s get to business and delve into the main reason why we are here. If you have been in the trading space for a while, then I am sure you most likely have heard at least one of order block or fvg. But what are these and what are the difference between these two?

Oder Blocks

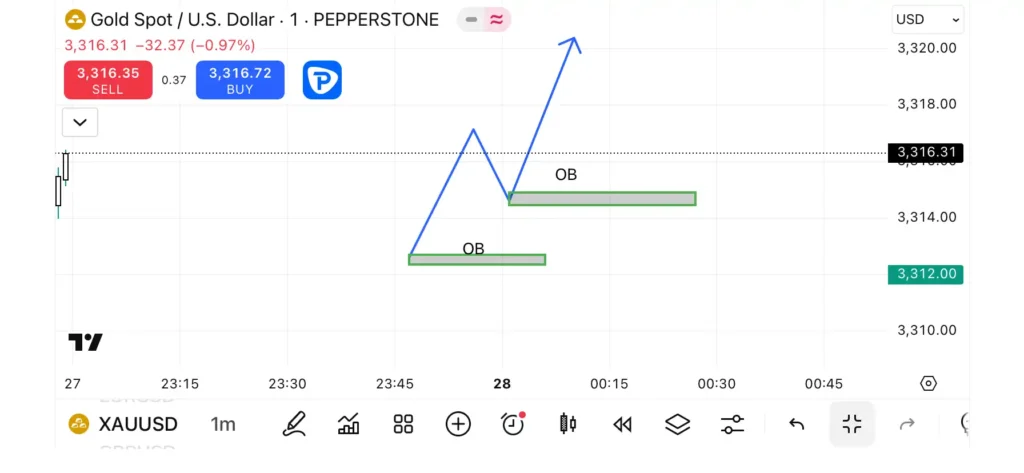

Basically, an order block is a combination of three candlestick formations where industry players like the banks place their orders. Now in the image below, I demonstrate to you what the candle formation looks like and how to spot order blocks when you see one.

Now, what is the prime purpose of Oder blocks? Well, have in mind that nothing is 100% guaranteed when it comes to forex trading. That’s exactly so with order blocks, it’s all about speculations and predictions with a high rate of happening.

So the aim is that price will pullback and respect the order block before price pushes back up. I’ll explain this into details later in this article.

FVG

FVG as largely known stands for “fair value gab” and as the name goes, this is a gab created after a formation of three candlesticks. It’s very similar to that of an oder block.

That’s why we have decided to talk about both order blocks and fvg in this article. The reason being that, these two are traded with the same strategy. Just like an order block, fvg is a zone on the chart where it’s mostly price will respect by coming back to tap into it before moving to the opposite direction.

How to trade Oder blocks and FVG

One rule you should never forget is that the fact that you can spot an oder block or a fair value gab does not mean it’s valid so price I’ll come back to tab into the zone before moving away from it.

Before an order block or a fair value gab trade is termed valid, there are some things you must see to be certain. As I mentioned, it’s not 100% guaranteed that price will respect your trading set up, but adding confluence gives it a higher chance of happening.

Market structure

Now before you even think of finding where order blocks and fvg lies, you must first find out what the market structure is. There are three types of market structures and they are, the bullish market structure , the bearish market structure and then the ranging or consolidating market structure.

A pro tip is that order blocks and fvg can only be traded when the market is either bullish or bearish. This means that you avoid taking trades when the market is ranging. Making same highs and lows above an illustration of the two important market structures mentioned.

Break if structure

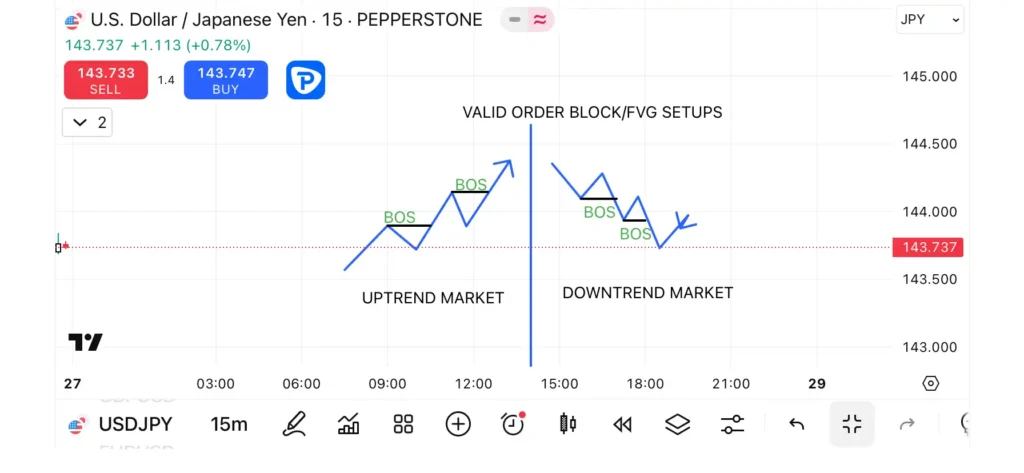

Of all the confluences we will talk about in this article, break of structure (BOS) is the most important one. After you confirm the market structure, you patiently wait for price to break recent high, “if the market is in an uptrend” or break recent low “if market is on the downtrend”.

For a better understanding of what a break of structure looks like on the chart, let’s consider a little bit of further explanation. We assume the market is bullish, signaling an uptrend in this example.

Now, what the market does normally is to pullback to grab liquidity and then move up to clear the recent high that was created. The image above demonstrates price breaking a recent high.

Always have it mind that if any of these things that we’ve talked about so far isn’t present, you’ll have to move away from the chart because a trade missed is better than a trade lost.

Liquidity Grab

Another important confluence, especially when it comes to trading order blocks is to wait for price to grab liquidity. In most cases, the liquidity that price has to sweep before tapping into your order block is the fvg.

Here’s an illustration of how it should look like. And also have in mind that after break of structure, there must be some sort of considerations present. What i mean is that if price comes down with one big candlestick move to tap into your zone then it’s an invalid trade and I’ll advice you resist.

In the image here, price sweeps liquidity where the arrow is pointed, attempted to move away and then reverse back to tap into your order block before finally move on to break recent high. That’s exactly how trading order blocks is basically done.

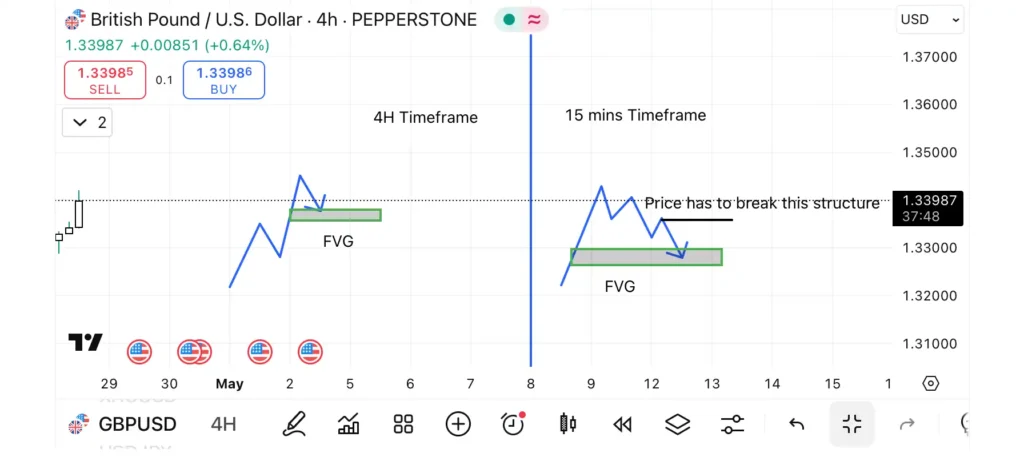

This type of order block trade is called the “aggressive smart money concept”. With fvg, there is a twist because most often if you trade aggressively you might be on the losing side. And by the way, you can use the 4H timeframe to analyze the market trends and then use the 15mins timeframe as your entry timeframe on order blocks and fvg as well.

With FVG, here’s the twist, instead of trading directly from your entry timeframe after using the 4H timeframe to analyze the market structure, you’ll rather locate the recent FVG on the 4H timeframe, wait for price to tap into the the FVG.

After that, you move to your entry timeframe which is the 15 mins timeframe to look for entries. And that’s very simple, all you have to wait for price to break the recent low or high depending on either bullish or bearish positions to create what’s called a change of character “CHOCH”.

After seeing that, you then wait for an FVG, wait for price to tap into it and then move in your direction. You can use the illustration in the image below for guidance

To be on a safe side, you can use this strategy on order blocks as well. I always tell my students that you do not have to know everything to become a profitable trader. Just master one strategy, backtest it a million times and then be profitable with it.

That’s it for this article, if you have any further questions, leave them in the comments section below and we’ll attend to you as soon as we can. Do well to browse the website or any of our free text courses for beginners that’s going to help you understand some of these terms used in this article and also equip you as a beginner on your journey to becoming a profitable trader.

Full beginner course on trading: Forex for beginners

Previous blog post: Best Scalping Strategy | How To Scalp

Pingback: How To Avoid Inducement In Forex Trading - 7educate.com